massachusetts estate tax table

This can be very confusing to tax and legal professionals in addition to. 3 900000 - 60000 840000.

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe.

. The Massachusetts estate tax for a resident decedent generally. A state excise tax. What Is The U S Estate Tax Rate Asena Advisors.

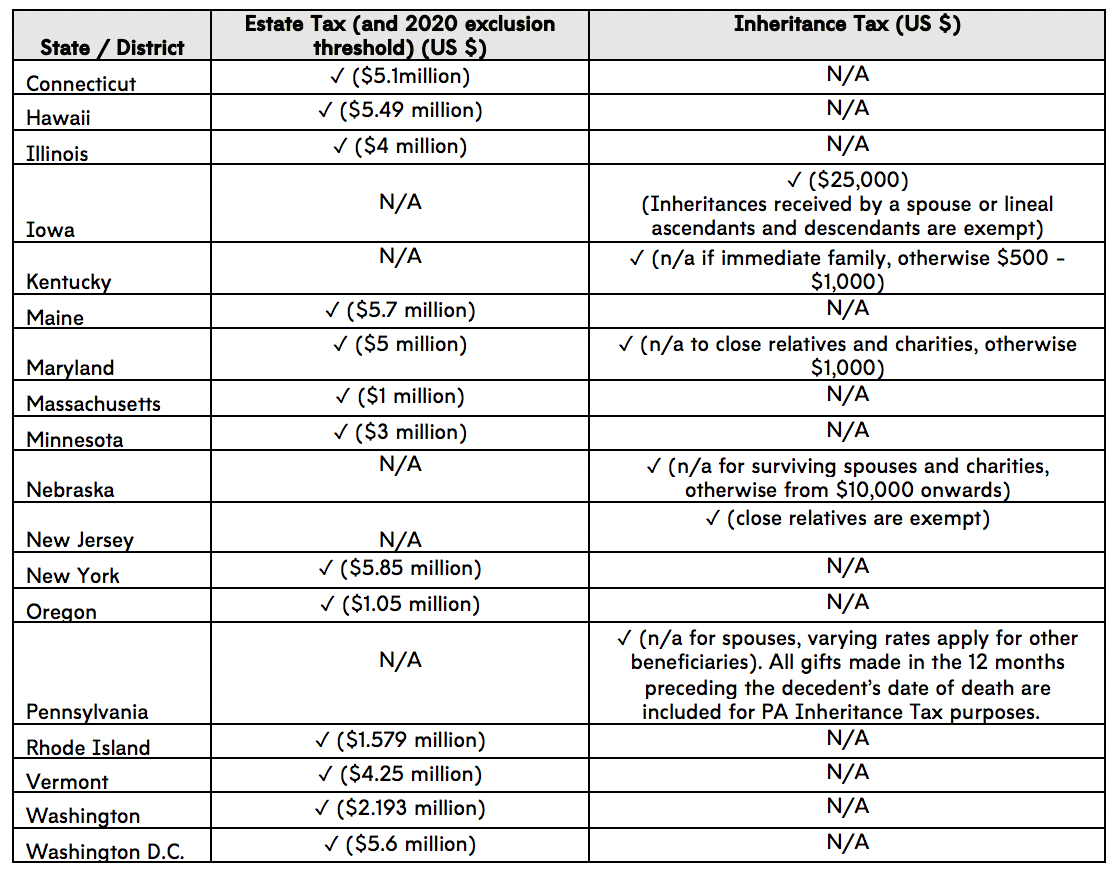

December 31 2000 see Massachusetts Estate Tax Return Form M-706. Estate Tax Rates Forms For 2022 State By Table. Computation of the credit for state death taxes for Massachusetts estate tax purposes.

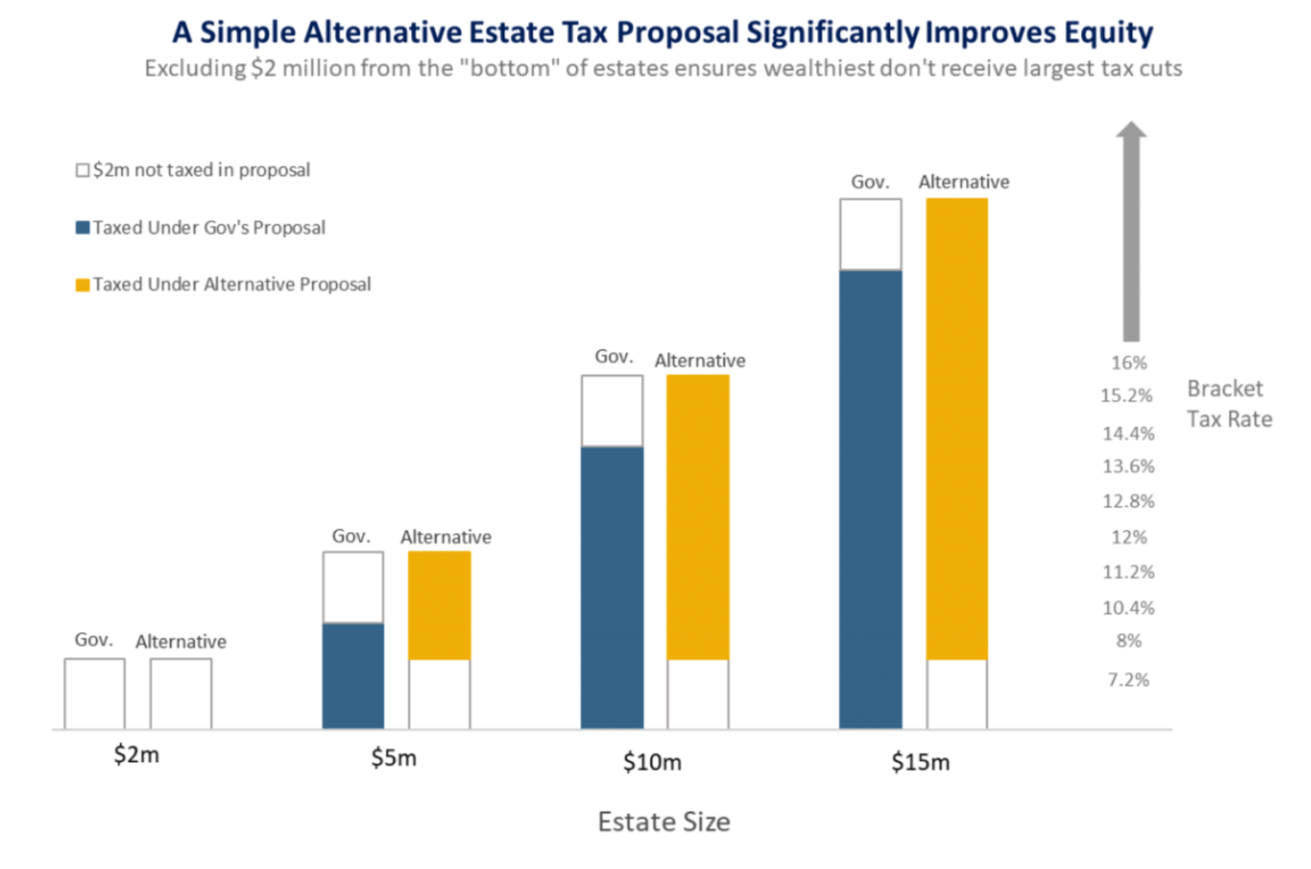

The Massachusetts State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Massachusetts State Tax CalculatorWe. Take a look at the Massachusetts estate tax rates table below. The graduated tax rates are capped at 16.

Under the table the tax on 840000 is 27600. The Massachusetts estate tax is a. So even if your estate isnt large enough to.

The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will.

A local option for cities or towns. A state sales tax. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976.

Estate Tax Rate Schedule And Unified Credit Amounts Table. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. The state sales tax rate in massachusetts is 625 but you can customize this table as.

Massachusetts Estate Tax Rate Table. The Massachusetts estate tax law MGL. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe.

For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. But dont forget estate tax that is assessed at the state level. US Estate Tax Return Form 706 Rev.

4 5 The term adjusted taxable estate means the taxable estate reduced by 60000 per Internal Revenue. A local option for cities or towns. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Where Not To Die In 2022 The Greediest Death Tax States

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

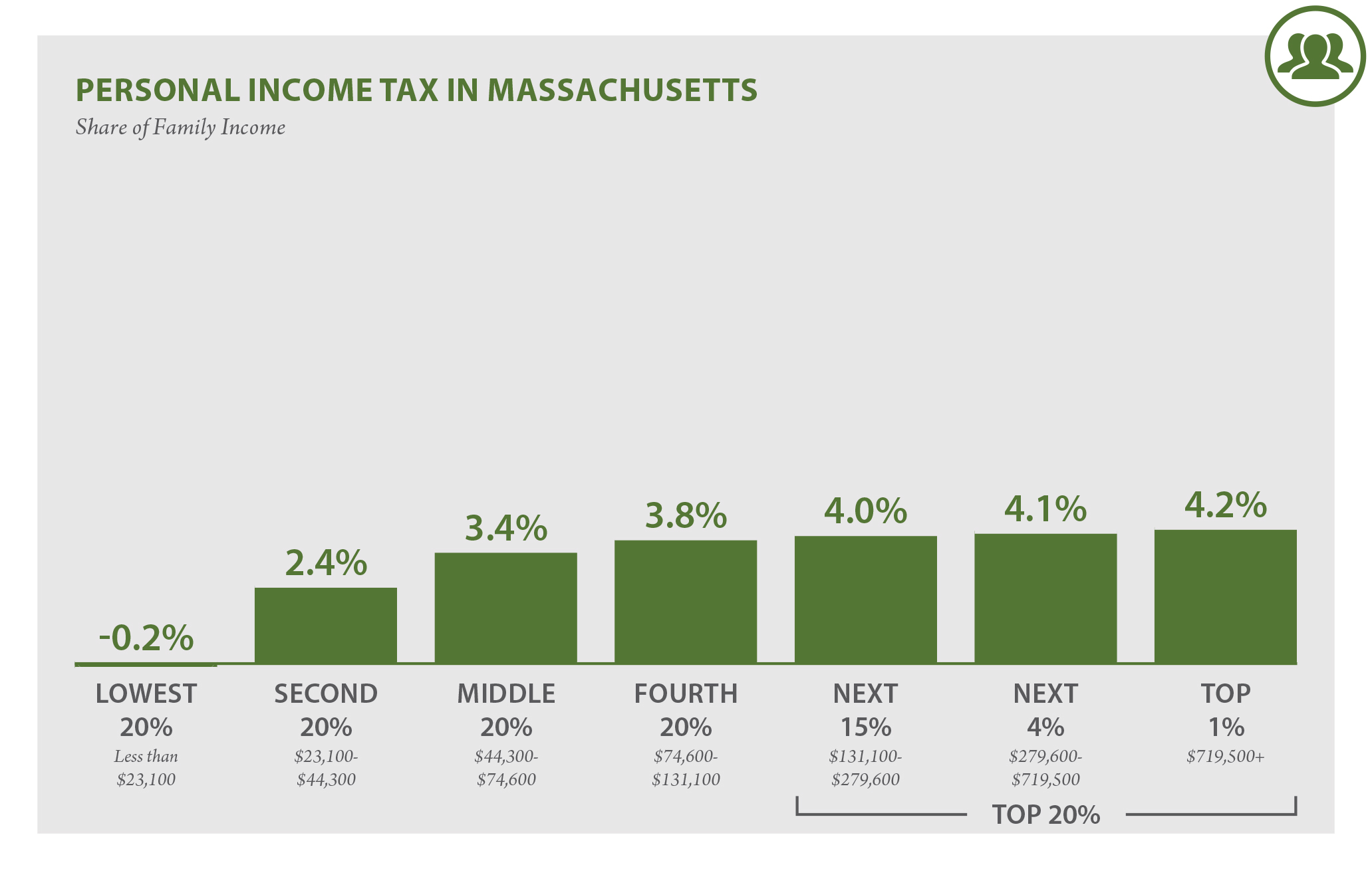

Massachusetts Who Pays 6th Edition Itep

2022 Transfer Tax Explained Bove And Langa

U S States Imposing Estate And Inheritance Taxes Asena Advisors

Dor Tax Due Dates And Extensions Mass Gov

Massachusetts Income Tax H R Block

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Massachusetts Estate And Gift Taxes Explained Wealth Management

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Estate Tax In The United States Wikipedia

Planning For Retirement How Attractive Is Massachusetts For Estate Tax Planning Don T Tax Yourself